On the anniversary of the infamous Hindenburg report, the group’s founder Gautam Adani said they have grown stronger as they launched crucial projects like the Dharavi redevelopment. In a leading daily he claimed that they have raised Rs.40,000 crore of equity and repaid Rs.17,500 crore of margin-linked financing, and pruned debt. Below is an unbiased brief of what the report said and what the Adani group had to say against the same.

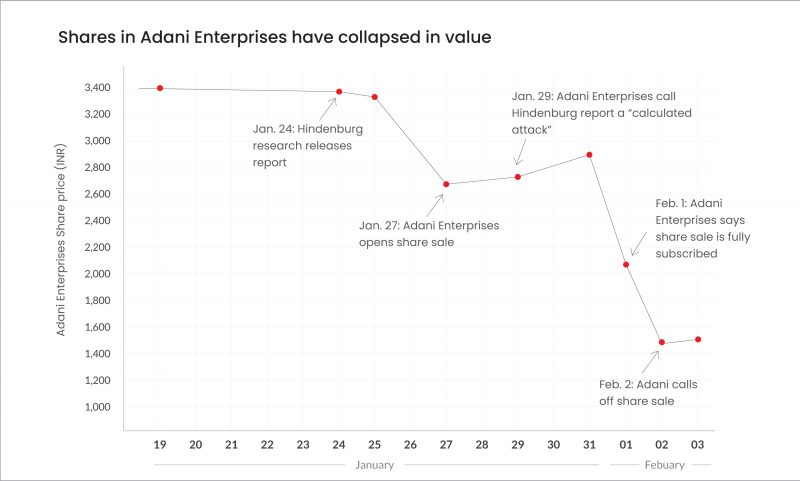

US-based short-seller Hindenburg Research made headlines on 24th January 2023 after they accused India’s Adani Enterprises of stock manipulation, unsustainable debt, and inappropriate use of offshore tax havens. The cascading effect of the report forced Adani to shelve Rs.20,000 crores of FPO.

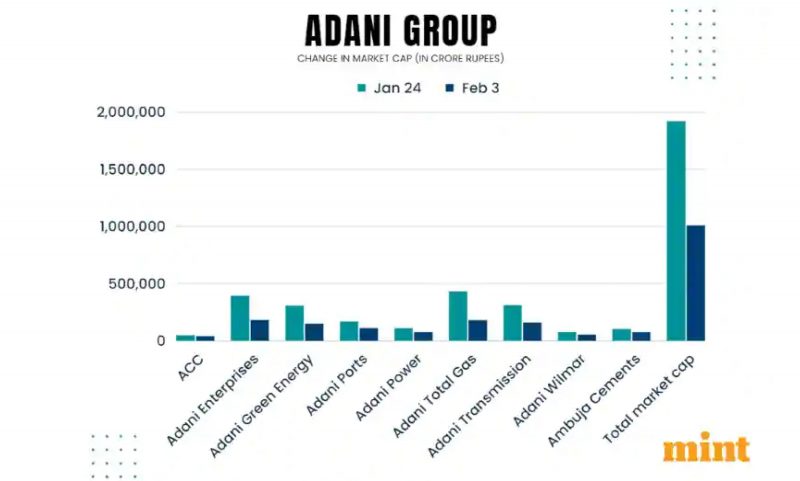

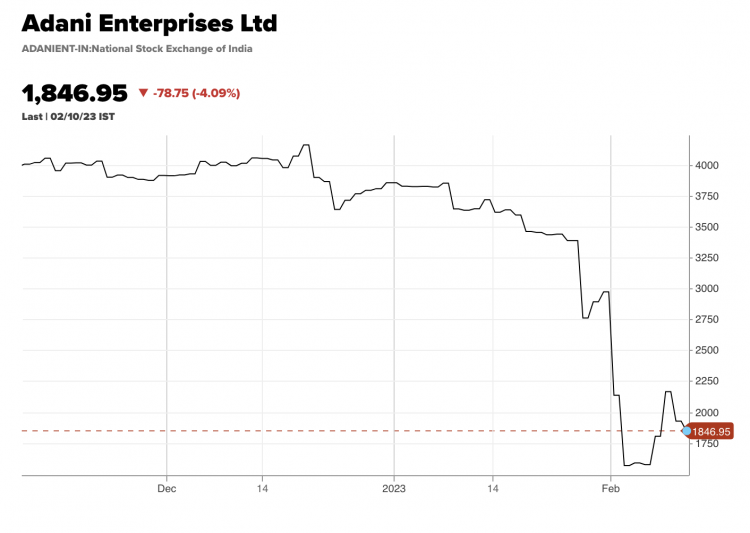

Adani Enterprises Limited is the listed holding company of the Adani Group—its primary business is mining and trading of coal and iron ore. Due to these grave accusations made by the Hindenburg Research report, the market capitalisation of their ten listed stocks tumbled from Rs.19,427 crore to Rs.8.79 trillion (source: LiveMint, chart attached). According to a report published in “Fortune.com,” the Adanis lost nearly $118 billion between January 24th and February 2nd. The chart below depicts the sequence of events during the aforementioned timeline.

As on February 4th, 2023, the group’s founder, Gautam Adani, was at number 21 on the Bloomberg Billionaire index with a net worth of around $59 billion after having lost a whopping $62 billion worth of wealth year-to-date.

According to a Nikkei Analysis, the liabilities accumulated by ten of Adanis listed subsidiaries, including ACC, Ambuja Cements and New Delhi Television, summing up to Rs.3.39 trillion ($41.1 billion), which is equivalent to around 1.2% of the Indian economy if pitted against India’s nominal gross domestic product of Rs.273 trillion as on October 31, 2022, as reported by the International Monetary Fund.

On January 28th, 2023, Adani Group issued a “notice to its investors” on their Follow-on Public Offer (FPO), where they mentioned to have categorically denied all the allegations made in the Hindenburg Research report. On February 1, Adani Group cancelled their flagship FPO worth Rs.20,000 crores just the day after it was fully subscribed, citing the unusual situation and fluctuating market conditions and the group’s intention to protect the interest of their subscribers.

A report published in Economic Times claimed that Adani Group Traders are offering discounts of nearly 4% on multiple coal shipments from Australia and Indonesia. While the group’s representatives didn’t specify any reason for the unusual discount offering, the subject matter experts in this field say Adani is probably trying to accelerate sales to boost its liquidity which has been under severe scrutiny since the release of the Hindenburg report.

On September 7th, 2022, the group’s founder Gautam Adani announced his plan to build three Giga factories to build solar modules, wind turbines, and hydrogen electrolysers as part of his $70 billion investment initiative in the clean and green energy sector by 2030. But the Hindenburg report’s accusations have raised serious doubts about the enterprise’s future, including its green energy ambitions. According to Bloomberg Intelligence analysts, Adani Green is at a peak funding risk attributed to its delicate balance sheet, having $1.25 billion worth of bonds due in 2024.

Adani’s side of the story

Over the years, Adani Group has contributed massively to India’s infrastructural growth needs. Their integrated business initiatives connect millions of Indians every day—Adani Group’s supply chain of ports and coal imports empower a significant chunk of India’s industrial power supply requirements. So far, they have developed over 3,100 miles of Indian roadways. According to a company presentation, the group is also the largest private operator of the county’s sea and airports, owning 33% of air cargo traffic and 24% of the shipping capacity. The Adani Group aims to plough around $70 billion into the renewable energy sector, which is critical to achieving India’s Net Zero goals. In April 2022, at the Bengal Global Business Summit in Kolkata, Adani Group’s founder Gautam Adani said, “I promise you that in the years to come, we will transform the skyline we see around us,” while posing with the Israeli leader Benjamin Netanyahu after acquiring one of their main ports, in Haifa.

Conclusion (or is it?) …

Since the Hindenburg storm, the group faced an array of setbacks, including the unintended cancellation of the Follow-on Public Offer (FPO). Considerable doubts have been raised about the future of Adani Green. The inevitable question is, is this the end of India’s biggest conglomerate after the Tatas and Ambani’s, or will they rise from the ashes like a phoenix?

If we look back at Adani Group’s most recent investments, they were significantly focused on sectors like agriculture, defence, and renewable energy—all of which are also high Indian government priorities. Having just published a rather ambitious budget on February 1st 2023, the central government is now facing questions on whether its highly ambitious infrastructure projects will be derailed and become collateral damage of the Adani downfall or whether both government and Adani will bounce back.

“The oak fought the wind and was broken, the willow bent when it must and survived.”

Leave a Reply